Global M&A deal database for investment teams

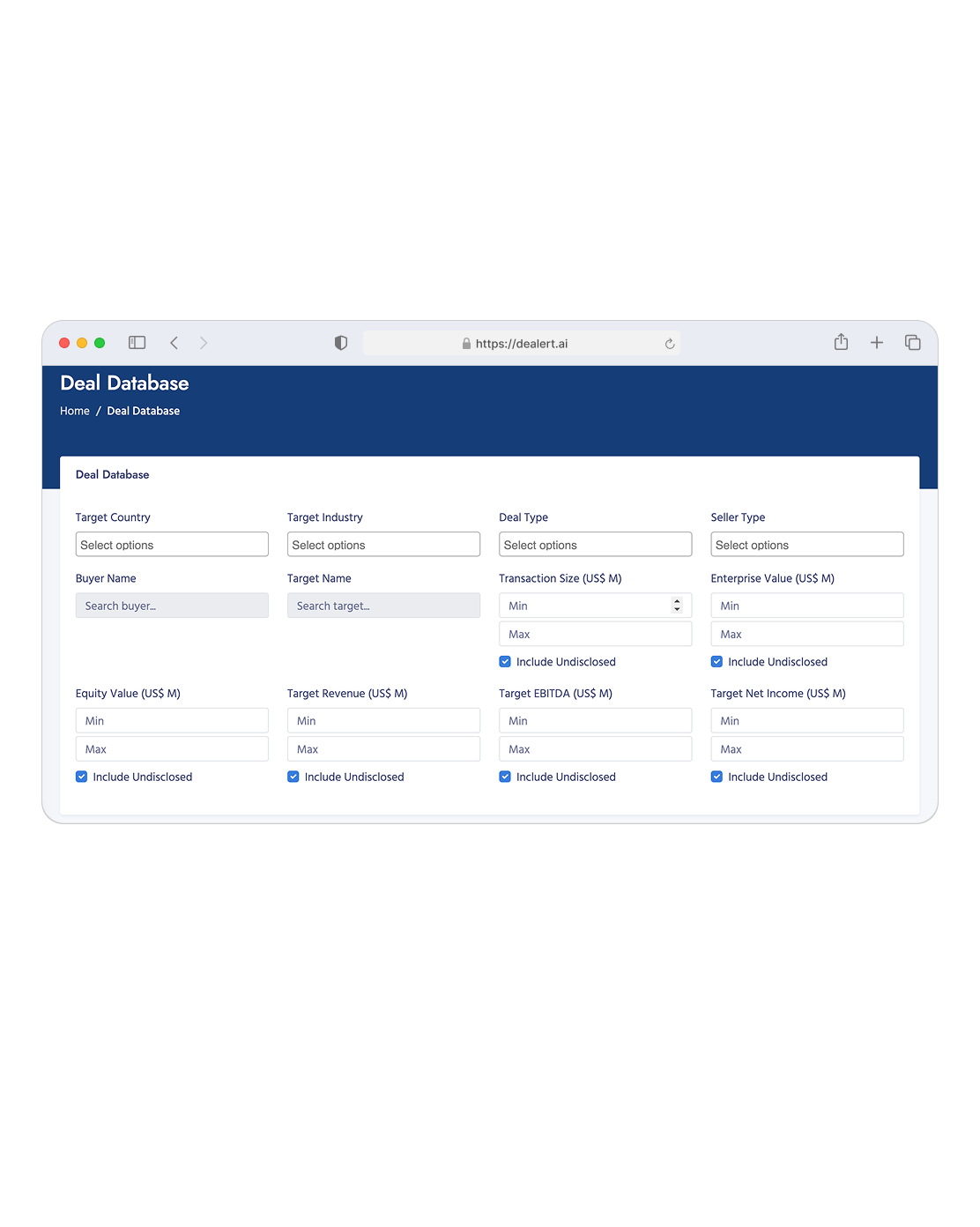

Search thousands of verified M&A transactions across all sectors and regions. Filter by size, geography, buyer type, and more - and turn raw deal data into clear, defensible comps.

Get instant access to the M&A deal database and receive curated updates on new transactions as they happen.

What is Dealert?

Dealert is an M&A transaction data platform for small & mid-cap deals. It’s a searchable database of completed M&A transactions – not a sourcing tool, CRM, or rumour feed.

Verified deal history

Search years of completed M&A transactions across sectors, regions, and deal sizes.

Built for small & mid-cap

Coverage tuned to the lower and mid-market where founder- and family-owned businesses change hands.

Not a sourcing tool

No rumours, no scraped email lists – just clean transaction data you can use in comps, decks, and IC memos.

Explore Dealert by use case

Whether you’re building comps, tracking buyers, or developing investment thesis, Dealert keeps all your transaction data in one place.

Deal tracker

Follow acquirers, themes, and regions with a live deal feed and alerts.

View deal trackerValuation comps

Build defendable transaction comps from verified deals, not rules of thumb.

Build better compsBrowse recent deals

Explore the latest transactions added to Dealert’s global deal database.

See recent dealsEverything you need to follow M&A activity

A live M&A transaction database, real-time alerts, and clean exports - everything investment teams need to track the market, build comps, and stay ahead of buyer activity.

Live M&A Deal Database

Access a continuously updated database of completed M&A transactions. Slice the market by buyer type, region, sector, and deal size - built for small & mid-cap advisory workflows.

Real-Time Deal Alerts

Follow niches, deal types and geographies with targeted alerts. See new deals as they close - no need to refresh screens or rebuild manual trackers.

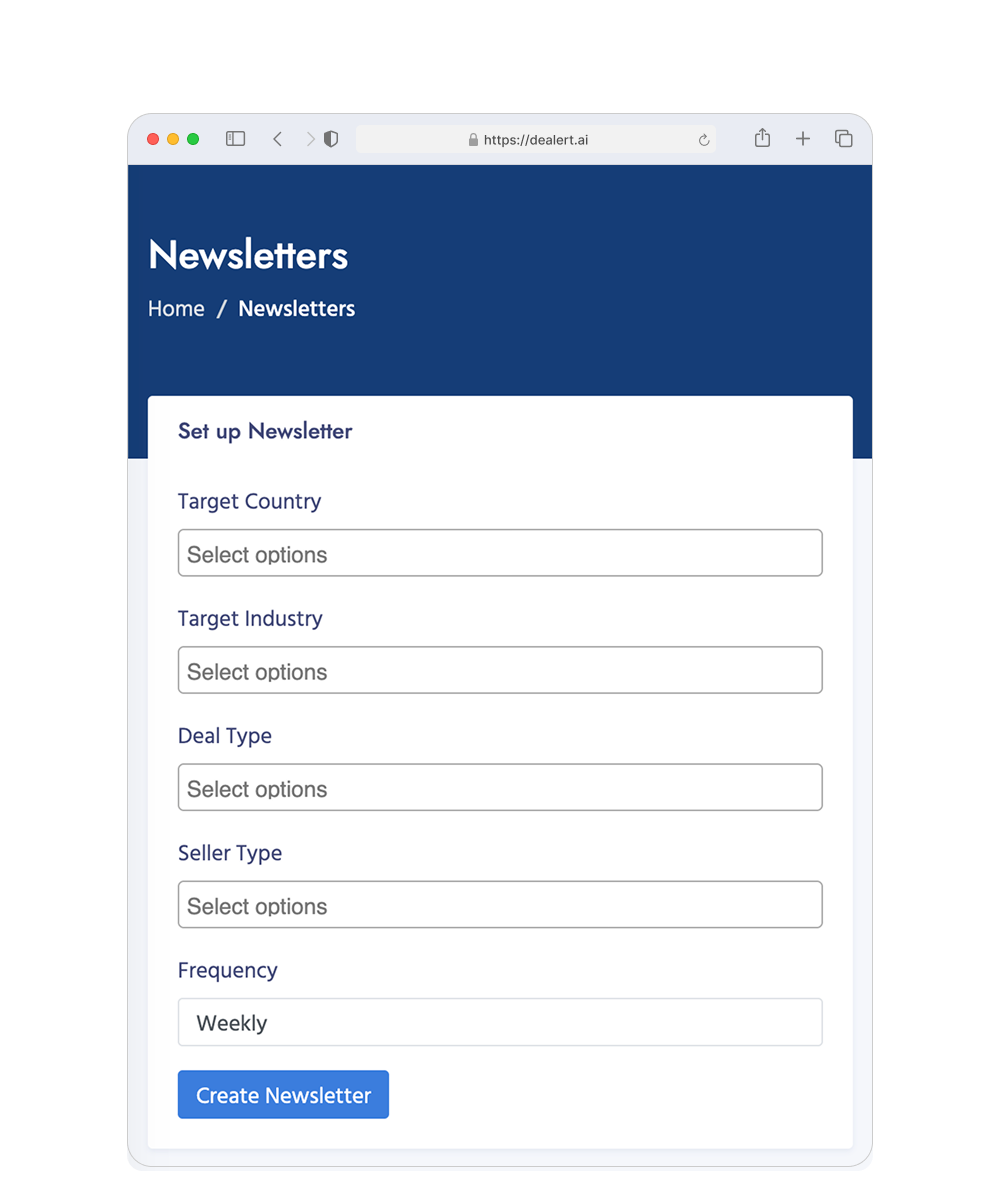

Curated Deal Digest

Prefer a lighter touch? Get a concise weekly summary of notable deals in your sectors. No noise - only verified transactions that matter.

Comprehensive Historical Coverage

Analyse consolidation trends, buyer strategies, and valuation ranges with structured historical data going back years. Ideal for thesis work, DD, and IC packs.

Powerful Filters and Saved Views

Build reusable views for specific sectors, regions, or buyer cohorts. Return anytime and instantly pull the updated market read.

Export-ready for analysis

Export clean, structured deal tables into Excel, decks, or internal models. No cleanup required - just comps you can defend.

Whatever your role in M&A - get a live view of the market in one place

Replace scattered PDFs, news searches, and spreadsheets with one live M&A transaction database. Build comps, track buyers, and prepare board-ready materials in minutes.

Investment Bankers & M&A Advisors

- Stay on top of market activity in your sectors with a continuously updated deal feed

- Track strategic and financial buyers with targeted real-time alerts

- Build credible comps and pitch decks faster with verified, structured transaction data

Private Equity & VC Professionals

- Identify active buyers and investors in your themes using real transaction data

- Track acquisition pacing, buyer behavior, and check sizes over time

- Support thesis development and DD with clean historical deal patterns

Corporate M&A & Strategy Teams

- Benchmark deals across regions, buyer types, and valuation bands

- Understand competitor acquisition behavior and consolidation plays over time

- Use real-time alerts to react to market shifts before they appear in board packs

Independent Consultants & Boutique Advisors

- Deliver big-firm-quality comps and market reads without big-firm tools

- Access a full M&A transaction database at a fraction of enterprise costs

- Configure alerts and digests tailored to each client mandate

Trusted by leading M&A and investment teams

Built for professionals. Priced for reality.

Enterprise M&A platforms cost $15k–40k per seat and come with contracts, onboarding, and unnecessary features. Dealert focuses purely on transactions - giving you the data you need, without the enterprise baggage - for just $49/month.

Fair Comparison

Compare Dealert to leading M&A intelligence platforms.

Dealert

- Pricing (annual): $490

- Deal coverage: All market caps

- Private company data: AI-Researched

- Rumors / leak detection: (Why?)

- User experience: Modern & Fast

PitchBook

- Pricing (annual): $20,000–40,000+

- Deal coverage: Mid / Large cap

- Private company data: Deep

- Rumors / leak detection: Limited

- User experience: Complex

Mergermarket

- Pricing (annual): $15,000–30,000

- Deal coverage: Mid / Large cap

- Private company data: Limited

- Rumors / leak detection:

- User experience: Traditional

Get started in under a minute

Take a sneak peek at the 10 most recently added deals

These are the latest verified transactions added to the Dealert platform — updated continuously to keep you ahead of the market.