Track Competitor Acquisitions & M&A Trends Without Breaking the Budget

Dealert enables corporate strategy and business development teams to monitor industry consolidations, track competitor acquisitions, and uncover market trends — all in real time and at a fraction of the cost of traditional M&A databases.

Built for Corporate M&A & Strategy Teams

-

Real-Time M&A Intelligence for Corporate Strategy

Track competitor acquisitions, industry consolidations, and strategic investments as they happen—without expensive financial terminals. -

Competitive Benchmarking & Market Insights

Analyze deal trends by industry, geography, deal size, and buyer type to understand market positioning. -

Custom M&A Alerts for Competitive Intelligence

Get notified instantly when competitors make acquisitions or when key deals shift market dynamics.

Our Coverage

Real-Time M&A Tracking for Competitive Intelligence

No more waiting for analyst reports—get instant access to global M&A transactions. Track competitor acquisitions, industry consolidations, and strategic investments in real time.

- Competitor Acquisition Tracking – Monitor rival companies' M&A moves and investment strategies.

- Verified Market Data – Aggregated from press releases, regulatory filings, investor reports, and proprietary sources.

- All Industries & Deal Sizes – Track market activity from early-stage acquisitions to billion-dollar takeovers.

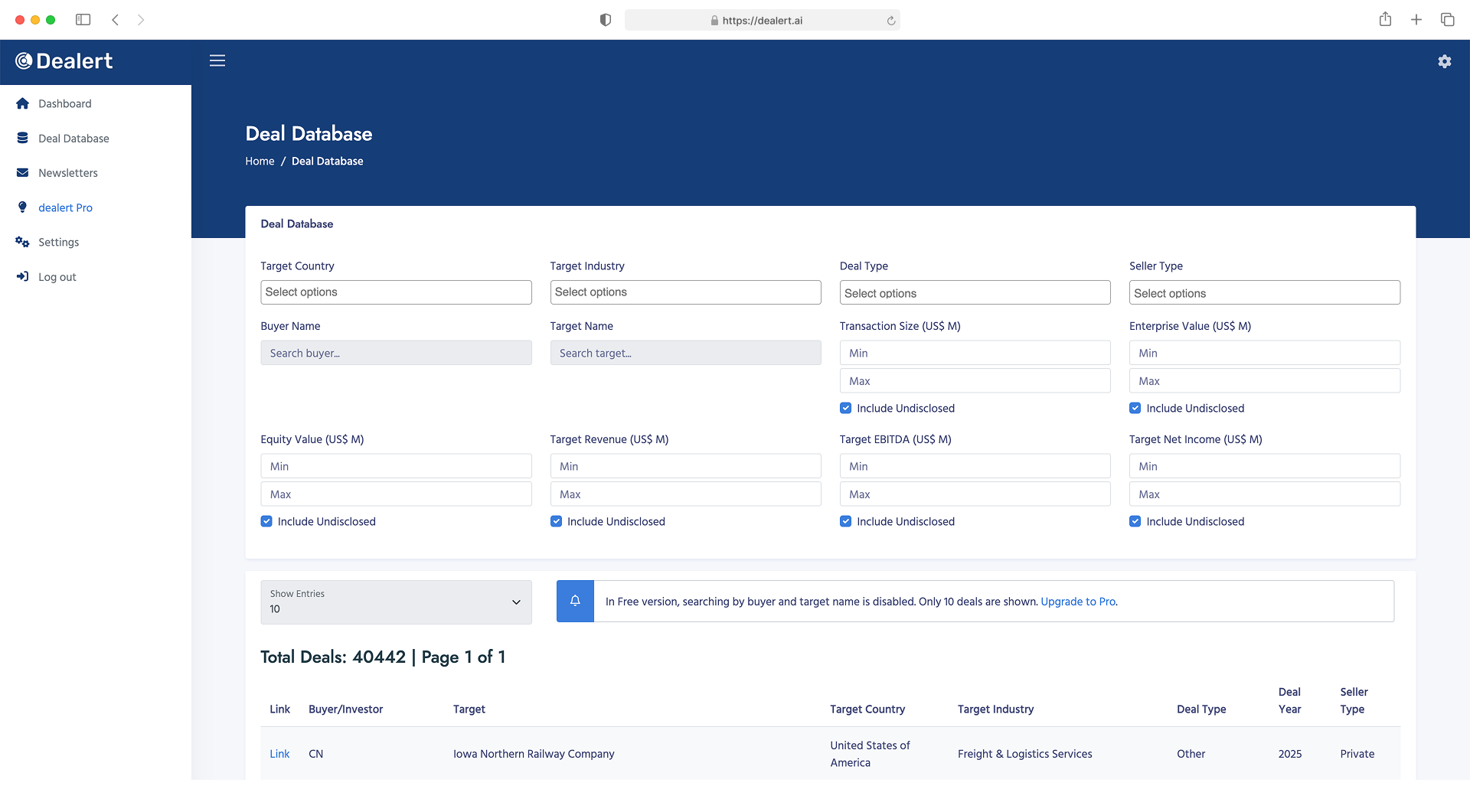

Advanced Search & Competitive Benchmarking

Finding competitor deals and market trends shouldn’t be complicated. Our intelligent search & filtering tools help you identify relevant transactions with ease.

- Filter by Industry & Competitor – Focus on M&A activity within your sector and key market players.

- Deal Size & Valuation Metrics – Compare M&A valuations, deal structures, and acquisition terms.

- Transaction Type – Mergers, acquisitions, carve-outs, joint ventures, minority stake purchases, and more.

- Strategic Investor Insights – Track corporate acquirers, PE-backed deals, and industry consolidation trends.

Custom M&A Alerts – Stay Ahead of Market Shifts

Corporate strategy is all about timing. Dealert keeps you ahead by delivering real-time alerts on competitor acquisitions and industry movements.

- Track Competitor M&A Moves – Get notified when key players make acquisitions or divestitures.

- Monitor Market Consolidation – Identify M&A patterns and assess potential risks and opportunities.

- Fully Customizable Alerts – Choose your industries, competitors, and transaction types.

How It Works

Monitor Competitor M&A Activity

Stay ahead by tracking competitor acquisitions, divestitures, and strategic investments in real time.

Analyze Market Consolidation Trends

Identify emerging M&A trends in your industry, track key players, and assess potential threats and opportunities.

Get Custom Deal Alerts

Receive automated updates on relevant deals, ensuring your team never misses an important transaction.

Make Data-Driven Strategic Decisions

Leverage real-time M&A insights to refine your business development strategy, identify acquisition targets, and benchmark against competitors.

Transparent Pricing for You

Free

$0 $0

- Limited Database Access

- Weekly Newsletter

- Alerts with tight filters

Pro

$49 per month $490 per year

- Unlimited Deal Database Access

- Fully Customizable Newsletter

- Flexible Filtering in Alerts

Stay Ahead of Competitor M&A Moves – Without Costly Subscriptions

- Track competitor acquisitions & industry consolidations in real time.

- Analyze M&A trends and benchmark against market leaders.

- Stay informed with real-time custom alerts on market activity.

- Full Access to Competitor & Industry M&A Tracking

- Custom Alerts on Strategic Acquisitions

- Analyze Market Consolidation Trends