Stop Guessing — Access the Latest M&A Transactions for Smarter Investments

Dealert gives private equity and VC professionals real-time access to private market transactions, helping you validate investment theses, conduct due diligence, and track exit opportunities—all in one place.

Built for Private Equity and VC Professionals

-

Precedent Transactions for Investment Thesis Validation

Find comparable deals to benchmark valuations, assess risk, and justify your investment strategy. -

Advanced Filtering for Due Diligence & Market Research

Drill down by industry, deal size, investor type, exit multiples, and financing structure. -

Exit & Competition Tracking

Monitor past investors, strategic buyers, and PE-backed transactions to identify exit opportunities and competitive moves.

Our Coverage

Instant Access to Private Market Transactions

No more incomplete or outdated reports—get real-time access to thousands of private equity and VC-backed M&A transactions. Whether you're validating an investment thesis, conducting due diligence, or tracking industry trends, Dealert gives you the data you need.

- Precedent Transactions – Compare past deals to justify investment decisions and benchmark valuations.

- Verified Private Market Data – Aggregated from SEC filings, investor reports, press releases, and proprietary sources.

- All Investment Stages Covered – Track early-stage VC rounds, growth equity investments, buyouts, and secondary sales.

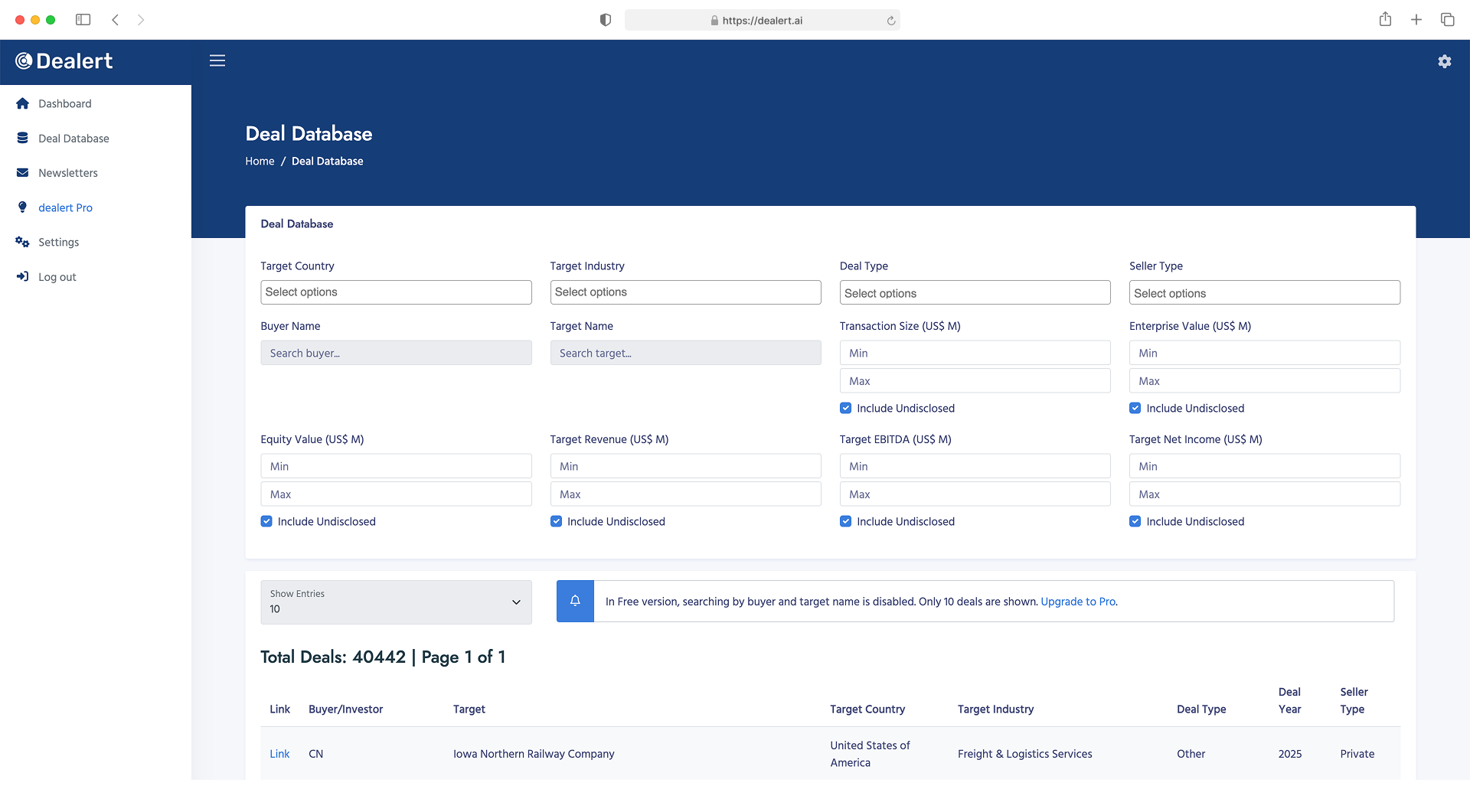

Advanced Filtering & Due Diligence Research

Finding the right precedent transactions shouldn’t feel like searching for a needle in a haystack. Our powerful filtering tools let you quickly refine your search and identify relevant deals.

- Filter by Industry & Sector – Focus on transactions that match your investment thesis.

- Valuation & Exit Multiples – Compare EV/EBITDA, EV/Revenue, and other key metrics.

- Deal Structure Insights – Analyze financing details, investor participation, and transaction terms.

- Exit & Buyer Tracking – Identify potential acquirers for portfolio companies and monitor competitor activity.

Custom Deal Alerts – Stay Ahead of the Market

Private equity and venture capital moves fast. Dealert ensures you never miss a key transaction by delivering real-time, customized alerts straight to your inbox.

- Track Private Equity & VC Investments – Get updates on fund activity and portfolio acquisitions.

- Monitor Exit Opportunities – Stay ahead of potential buyers and liquidity events.

- Fully Customizable Alerts – Choose your preferred industries, investment stages, and exit strategies.

How It Works

Find Precedent Transactions

Search our M&A database for private equity and venture capital deals, analyze transaction terms, and compare valuation multiples.

Conduct Faster Due Diligence

Assess buyer activity, financing structures, and deal terms to evaluate investment risks and opportunities.

Monitor Competitors & Exit Trends

Track private equity exits, strategic acquisitions, and secondary buyouts to identify potential buyers and competitive shifts.

Make Data-Driven Investment Decisions

Leverage real-time M&A intelligence to support valuations, identify acquisition targets, and optimize exit strategies.

Transparent Pricing for You

Free

$0 $0

- Limited Database Access

- Weekly Newsletter

- Alerts with tight filters

Pro

$49 per month $490 per year

- Unlimited Deal Database Access

- Fully Customizable Newsletter

- Flexible Filtering in Alerts

Find Precedent Transactions & Analyze Exit Strategies

- Instantly access private equity & VC-backed M&A transactions.

- Benchmark valuations & financing structures with real-time data.

- Track exit strategies and competitive acquisitions.

- Save time on deal research with AI-powered transaction insights.

- Affordable pricing—only $49/month or $490/year.

- Trusted by investment bankers, M&A advisors, and private equity professionals.